The investment goal for 2021 revealed

My Investments began in 2020!

2020 have been a special year for everyone on this planet. It sent people home from their jobs and people definitely felt stuck at home for majority of the time during 2020. However, for me 2020 has been the year where i kickstarted my investments and learned a lot about Financial Independence Retire Early (FIRE).

During 2020 I have followed a very simple investing strategy of following the market and selecting a very few very well known companies which is dividend paying companies.

I had no special target, and in the beginning i had a goal of investing 400 USD every week to follow the dollar cost averaging methodology (Roughly 1500-1800 USD per month). However, after only 3 months of investing every week. I found it was way too cumbersome for my investment style to invest every week.

Therefore, I switched strategy slightly to simply invest a minimum of 2000 USD once a month.

The investment result of 2020 is:

After a year of investing my portfolio write 32,999.55 USD on 1st January 2021. This equal 255,814 HKD in my local currency. On average I have invested 21320 HKD (2749 USD) each month including gain, and dividends. In 2020 of my 255,814 HKD (32,999 USD), a total of 4,139 HKD (534 USD) have been from dividends payouts and of the rest 5.77% has been capital gains. I’m quite satisfied with this result and it makes me super excited since I had no idea about dividends and capital gains in 2019 until studying in late 2019, start 2020. Click here to see my current portfolio on eToro

During 2020, I also filled up my emergency fond of 130,000 HKD. which should cover around 4 months of expenses at the same lifestyle. Lastly during 2020 I saved up for payment to a house when one day moving back to Denmark. It is not quite enough for the full payment yet, however, it does have 100,000 HKD saved up so far. With a filled emergency fond and house fond half way, I believe I can add additional to my investment portfolio in 2021. If you are interested in my current net worth you can read this article.

My new investment goal in 2021

From 255,000 HKD (33,000 USD) in 2020 to over 500,000 HKD in 2021

A single year of investing and learning about FIRE made me become very excited about investing.

My new target for 2021 is to reach a portfolio of just about 500,000 in pure stock/EFT investments. This should be achievable with my budget and you can find my reason below.

I still have many years left to invest, before retirement. But every time I get my salary I’m counting the days until I can hit transfer from my bank account and throw them into the market. Every month on the 26th, I receive my salary, and on 28th I have paid all my bills and I can then see how much I can actually invest during that month.

2020 I had to fill up my emergency fond of 130,000 HKD, which roughly equal 10,000 HKD each month I had to use for this. Further my house fond and car fond I have been transferring roughly 15,000 HKD towards each month. For 2021, I do not need to send money for my emergency fond, and I plan to cut down towards car and house.

a cool fact, which excites me incredibly much is if I decided to not invest a single penny more into my portfolio, I can see for 2021 I would receive 7015 HKD (905 USD) from dividends. This is quite cool.

My goal and plan for 2021 is, I plan and hope I can invest at least 21,000 HKD (2700USD) every month. This is 252,000 HKD in 1 year. That should put my portfolio to above 500,000 just by my own contribution without dividends or capital gains.

An outlook and hope of end result for 2021:

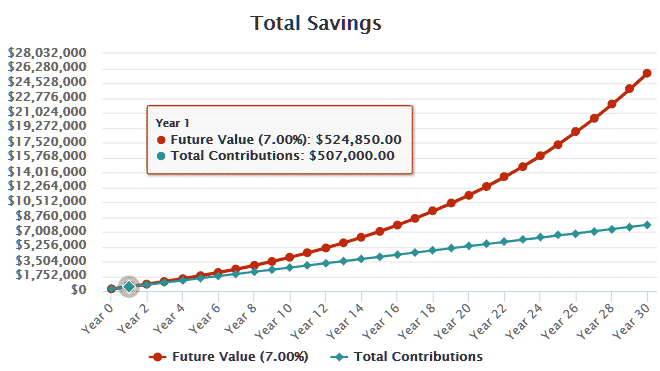

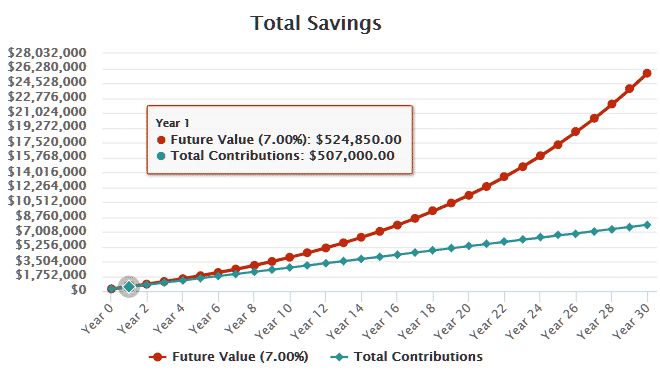

However, if I imagine, my current portfolio is 255,000 HKD after 2020, I invest 252,000 HKD in 2021 and get capital gains of roughly 7%, which is my gains target. I hope to see my portfolio be 524,850 HKD as per below graph. That mean in only 3 years my portfolio would be about 1,000,000 HKD (129,000 USD).

If you want to see when you can become financial independent read this article

Net worth Update November 2020

Net Worth update – New milestone – Net worth more than 500000!

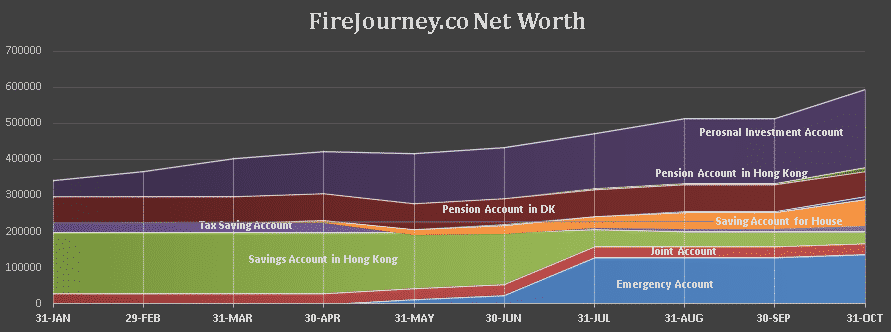

As part of taking the journey to Financial Independent. It have been important for me to track my Net worth and set my goals.

Tracking your net worth is important to see you are heading the right direction and the growth is reaching our goals. This way you can take status on your progress and determine if any adjustment is needed.

Do you have a hard time seeing where your money is going, then tracking your net worth will help show where the money is ending up each month. Did you read august net worth update, where I went more in detail with my acount! Check it out

Benefit of tracking net worth

Before, I was tracking my net worth I didn’t realise how much my student loan actually dragged me down. Now I know exactly what i have in my account, however, considering the debt, I know where I could be there, but more importantly in reality where i am.

One time a month I’m going through my accounts to determining my income, saving and spending. It is rather manual, but have become a monthly routine which I feel have significance to my life. I highly enjoy seeing my account grow. Every single month I complain my high internet and electricity bill! But I only realize it because I’m going through my accounts

My new 1,000,000 dollar milestone!

In August I said I had 2-3 month until I passed my 500000 milestone. Now it is it time to reflect on what brought me here in less than 2 years. I’m considering tracking my income since 2018 when I arrived Hong Kong because truly I started from 0 dollar on the account. Every day im grateful and happy I’m been able to save up so much money for myself and my family.

My new milestone is 1,000,000 for my own account alone, they say the first million is the hardest. When I’m tracking my net worth it is my own account only (except the joint account, we barely use). The reason I’m not tracking the whole family balance is because I want to completely ignore we have that income so if I lost it it would not impact our life’s much.

So when I’m able to take nearly 50% saving rate it is excluding my wife salary. My wife actually able to save 100% of her salary because all fixed recurring expenses (except our Nanny) is charged out of my account. In reality she have spending every month so her saving rate is lower but if she keep her card in the pocket it is Immediately saved.

How to calculate your own net worth?

Net Worth = Assets – Liabilities

New target is 1 million in Net Worth!

As of 1 November, I’m just above with 565000 HKD in net worth.

If you are born poor it’s not your mistake, but if you die poor its your mistake.

If you don’t find a way to make money while you sleep, you will work until you die.

Net worth Update – Half million target

Net Worth update – Journey to 500.000 or my first half million!

As part of taking the journey to Financial Independent. It have been important for me to track and set out my goals.

Tracking your net worth is important to be able to see if we are in the right direction as we want. It also help to show where could we likely save money.

Before, I was tracking my networth I didn’t realise how much my student loan actually dragged me down. Now I know exactly what i have in my account, however, considering the debt, I know where I could be there, but more importantly in reality where i am.

I’m doing my net worth calculator by myself, if you would like to have the same tracker, let me know in the comments below.

How to calculate your own net worth?

Net Worth = Assets – Liabilities

2-3 months away to half of a million in Net Worth!

According to my estimates I’m only 2-3 months away from my first half million.

As of 1 August, I’m just below with 443000 HKD in net worth.

If you are born poor it’s not your mistake, but if you die poor its your mistake.

If you don’t find a way to make money while you sleep, you will work until you die.