What is Dollar Cost Averaging?

Invest in funds or stocks by making regular monthly contributions. Acquiring new stocks at different prices i.e. buy more units when the unit price is low and buy fewer when the unit price goes up.

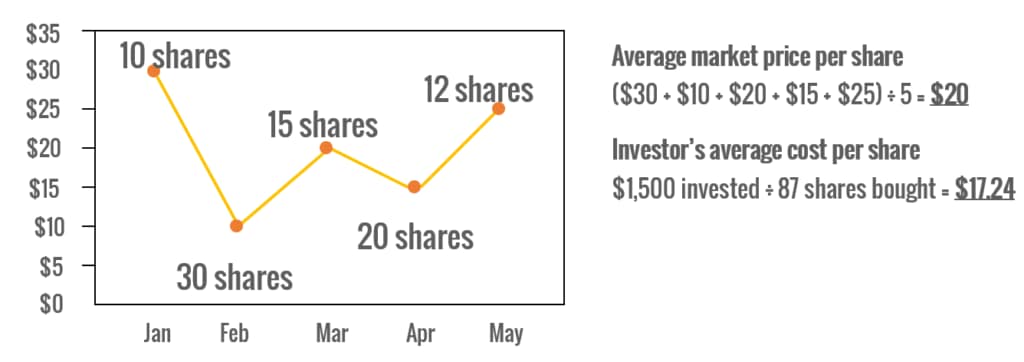

Over time, the risk arising from short-term market fluctuations will be reduced as a result. The example below illustrates the benefits of Dollar Cost Averaging through a monthly contributions to an investment portfolio. Dollar Cost averaging is especially powerful in a bear market, as you have a higher chance buying the dips compared to Lump sum investing.

Why Use Dollar Cost Averaging?

It’s easy to imagine scenarios in which a lump-sum purchase beats dollar-cost averaging. But in general, dollar-cost averaging provides three key benefits that can result in better returns.

- Avoid mistiming the market

- Take emotion out of investing

- Think longer-term

In other words, dollar-cost averaging saves investors from their psychological biases. Because investors swing between fear and greed, they are prone to making emotional trading decisions as the market gyrates.

How to Dollar Cost Average?

Dollar cost averaging is the act of consistently investing in a particularly security over a set interval of time. Most like to invest every two weeks or every month since that’s when most get paychecks. The important part is being consistent, it will help you to turn your investment into a habit, and a simple act. You also do not need to invest into the same every time. As long you are investing into your portfolio on a weekly, bi-weekly, or monthly basis.

The steps to executing a dollar-cost averaging strategy are simple:

- How much money you want to invest in a particular stock or fund.

- Decide how often you want to make your investments: daily, weekly, monthly, quarterly, annually, or virtually any interval you can think of.

- How many periods you want to split your investments over.

- Divide the total dollar amount to invest by the number of time periods to determine the amount of each investment.

Should I Dollar-cost average on a weekly or monthly basis?

People have different preferences, and personally, I tried a bi-weekly schedule in the beginning and have later switched to a monthly basis. It comes down to your personal preference and in most circumstances find something matching your payday schedule for convenience.

The benefit of dollar-cost average more frequent than e.g. monthly would be you get an average price much closer to the actual price and in the event of dips, you have a higher chance of hitting the bottom of the dip.

The disadvantage is the additional work associated with more frequent pay and beware of trading fees. If your platform charges a commission (especially minimum commission) it would be cheaper to trade once a month rather than weekly.

My last point on using a dollar-cost average weekly or monthly schedule is whatever the way choose something you can make a habit out of and you will be able to uphold. My personal reason switching from bi-weekly to monthly was because I found myself missing the schedule. Few weeks I lacked the money, or I simply forgot to trade. Now I’m using a monthly plan, with automated transfer the day after my salary comes in.

If you prefer videos of the topic I got you covered.

This video of Jack Bogle, where he is explaining DCA and his views on DCA. Jack Bogle is an extremely talented investor. He was the founder of Vanguard and is credited for creating the first index fond.

Let me know what you think in the comment belows.