STOCK INVESTING

Issuing shares is a great tool for companies to raise capital and for investors to share in the value creation of companies.

Equities are a must in any investment portfolio.

In this post, you will concretely learn more about what stocks are, where and how they are traded, and why a passive investment strategy is the easiest way to invest in stocks.

We have to look back a bit in history and we even get a visit from a well-known king and a Dutch swindler.

We will get around the following topics in this post:

1. What is a stock?

2. How to make money as a shareholder?

3. The history of the stock

4. The very first Danish share

5. The purpose of joint stock companies

6. The purpose of the stock exchange

7. The digitalisation of the stock market

8. Stock index

9. What can stock indices be used for

10. Passive and active investment strategies

11. Buy one fund and become a co-owner of thousands of different stocks

12. Active and passive funds

13. Passive investment in shares via E-Toro

WHAT IS A SHARE?

With a share, you own a share in a company. If you own shares in a company, you are therefore a co-owner of the company in question.

This is also what is called being a shareholder. As a shareholder, you are entitled to parts of the value the company creates. We will return to that shortly.

Companies that are characterized as public limited companies, can be either unlisted or listed public limited companies. If a given company is unlisted, then it is a private company, where the shares are not freely available for trading on the stock exchange. If the company is not listed on the stock exchange, the shares can only be traded outside the stock exchange.

An example is when the Shark in in the TV Program “Shark Tank” buy into companies.

If, on the other hand, the company is listed on the stock exchange, the shares can be traded freely on the stock exchange where the company is listed.

In the “old days”, stocks were traded on a physical exchange and the stocks were actually represented by physical securities.

Yes, in fact, it’s a bit misleading to call it “old days,” because we are not going back that many years before it was still common for people to shout and scream buy and sell orders, as you have probably seen in countless movies.

HOW TO MAKE MONEY AS A SHAREHOLDER?

As a shareholder in a company, there are basically two ways in which you can make money.

It is by respectively:

- Value increases

- Dividends

Since the shares in the company are traded on an exchange and the pricing of the shares here is free, you can make money on shares by buying them at one price and selling them for more than you paid. You have thus made money on the actual increase in value.

The other way to make money on stocks is through dividends. Many listed companies regularly choose to pay dividends to their owners, the shareholders. This often happens this year, when the company has made a profit – then they practically distribute part of the profit to shareholders.

Here there can be a big difference, both in terms of the size and frequency of the yields. In some parts of the world there is a tradition that dividends are paid several times a year, but in Denmark it usually happens once a year (in the spring).

THE HISTORY OF SHARES

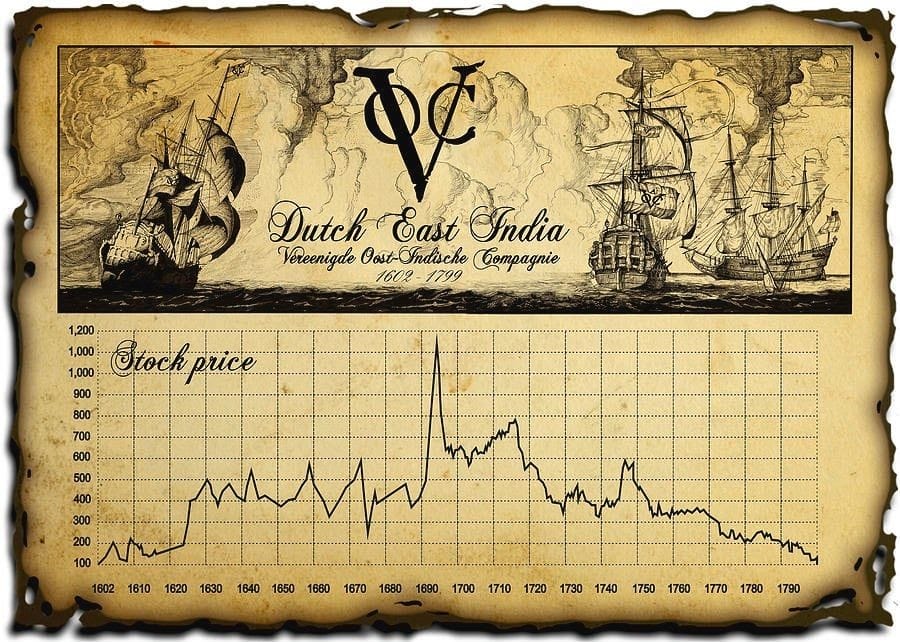

Stocks as we know them today emerged in the early 17th century and heralded an explosion in world trade.

This applies, for example, to the famous English “East India Company” and the no less well-known “Dutch East India Company”.

In 1602, shares in the “Dutch East India Company” became possible to trade on the Amsterdam Stock Exchange.

With this, there was a real and formal market for buying and selling shares in a company – it grew to become the world’s first multinational company.

In the heyday of the company, they possessed an army of 10,000 soldiers and had enormous power. It is a bit the same as what we are today, where few large tech companies sit with an enormous power that extends far beyond the borders of the country where they originated. So this is not a new phenomenon.

In addition, equities have always been a volatile affair. This means that the price of stocks is moving like waves at sea. Sometimes up and other times down.

See, for example, the price of “Dutch East India Company” over the company’s small 200-year life.

WHAT IS THE FIRST DANISH SHARE?

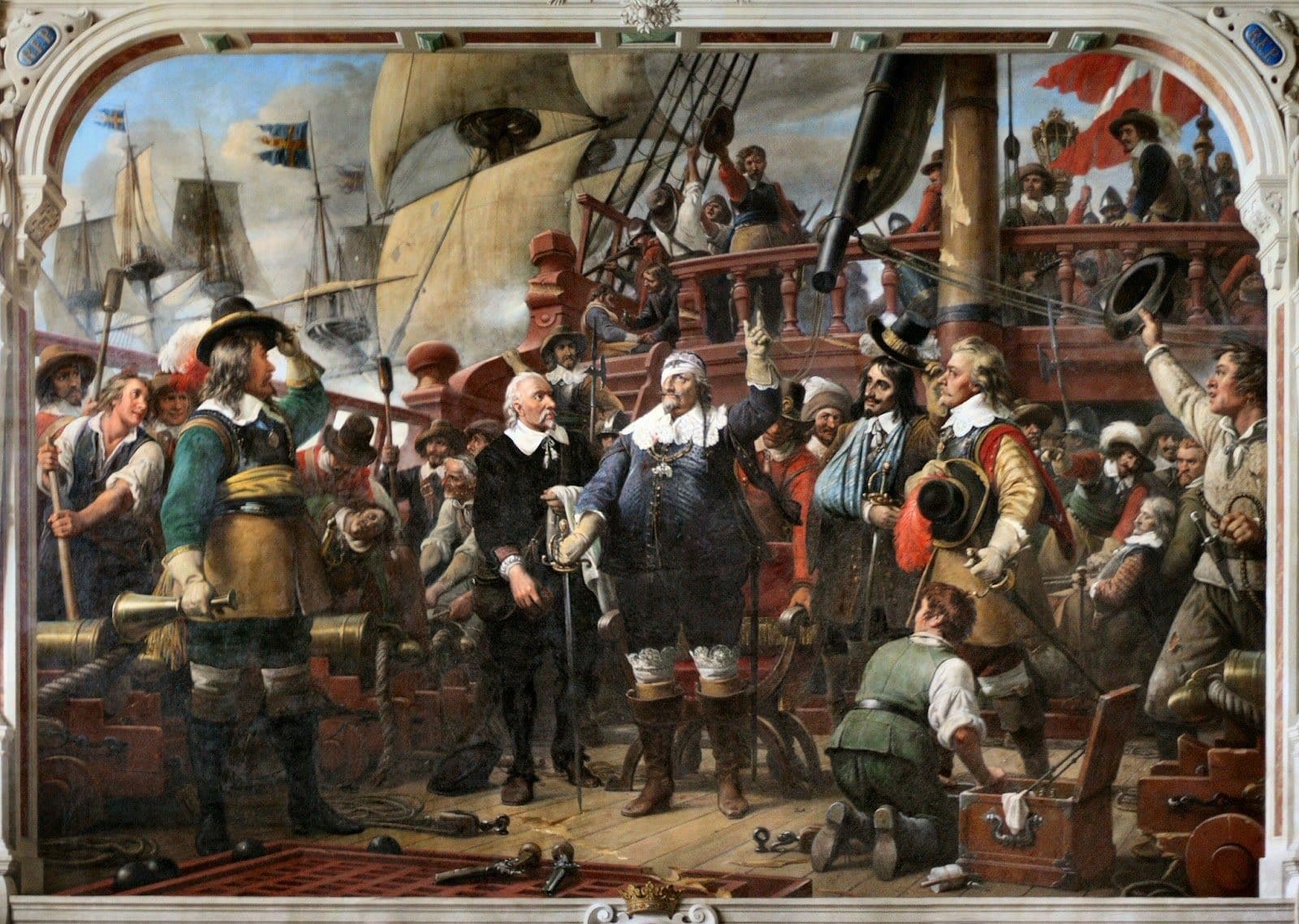

King Christian IV is probably our most famous king and here he again plays a role. It is simply he who in 1616 established the first Danish limited company under the name Dansk Ostindisk Kompagni.

It took a lot of money to make the risky trade trips to the East, but the return was potentially huge for investors as well.

- The ideal circumstances for raising capital through a corporation.

Part of the fairy tale about the first Danish share is also the colony Trankebar and thus Denmark’s entry on the world stage as a colonial power.

Unfortunately, the story of the first Danish share does not end happily. A Dutch big scammer named Marcelis de Boshouwer sold the dream of exclusive rights to trade with the Emperor of Ceylon (the country we know today as Sri Lanka).

This was simply what made the first Danish share see the light of day at all. There was just no emperor.

- The background for Denmark’s first public limited company was both fraud and deception.

What is the purpose of joint-stock companies?

Establishing a joint stock company is basically a way for the company to raise capital – that is, a way to raise money for a company. Instead of one person / a smaller circle of people having to bring all the money, it opens up for more people to share in the wealth the company can create in the future.

Capital makes it possible as a company to grow and create jobs. It is also a way for the average person to get his share of the profit that the company creates.

That was true then in the 17th century and it is true today.

In this way, it is an expression of a democratization of access to the increased prosperity society creates over time.

It must be said to be a win-win situation.

WHAT IS THE PURPOSE OF THE STOCK EXCHANGE

It is difficult to separate shares from the given stock exchange on which they are traded. The stock market plays a very important role when it comes to trading shares.

The obvious thing, of course, is that it creates a place where trade can take place. It facilitates access to buy and sell stocks.This applies both in the digital age, which we will look at in a moment, but it also applied to the time when trading on the stock exchange required you to show up in person.

The stock exchange also helps to ensure better (and more accurate) price formation. If stock trading takes place in one place, it is easier for buyers and sellers to see and sense what others think stock in a particular company is worth. They start to skew to each other when it comes to making a purchase or a sale and this ensures more accurate pricing.

A third purpose is to ensure a company the opportunity to raise capital – that is, which we have also briefly mentioned before. If there is one place, the stock market, where potential investors with money flock, then it is an obvious place to seek financing for one’s business idea. In English, it is called an “Initial Public Offering, IPO”, and in Danish it is simply a stock exchange listing when a company makes it possible to buy and sell shares in the company.

- The purpose of the exchange is therefore mainly to unite buyers and sellers, ensure better price formation for the shares traded and make it possible to raise capital for a company.

The most famous stock exchange in the world is without a doubt, the New York Stock Exchange “NYSE”, located on Wall Street in New York. The address is actually a bit funny, because back in the time in the 17th century when New York was called New Amsterdam and was Dutch, there was a wall where Wall Street is today. That’s why the street got that name.

THE DIGITALIZATION OF THE STOCK MARKET

With the digitalization of the stock market on the stock exchanges, it has become possible to invest in companies from all over the world at home from the living room.

So with your smartphone in hand, you can now decide what price you are willing to give to become a co-owner of the latest and hottest tech company from Silicon Valley.

It may seem unbelievable, but basically it is the same thing that happened back in 1602 on the Amsterdam Stock Exchange. The fact that the stock market has since become much more democratized, allows for far more people to participate.

- The wealth management of the future is digital

Digitization opens up a number of possibilities. Trading in modern times on the stock exchanges is like never before. - Several generally trade shares

- The shares are traded more frequently

This sharpens both the pricing of shares and provides increased liquidity in the market. This is good for you as a private investor as it increases the likelihood that you will buy the shares at the right price and thus not be cheated.

WHAT IS AN STOCK INDEX?

When it comes to stocks, they are issued all over the world and in every conceivable industry. These can be small, medium-sized as well as large companies. The limited companies offer very different products/services.

We, humans, are happy to be able to put things in boxes and here the stock market has not escaped our urge to sort and filter.

Thus, there is another sea of different indices. The index is a way to divide different stocks.

- The world’s first stock index was launched on July 3, 1884, and was called the Dow Jones Transportation Index.

The index consisted of 11 different equities in the transport sector, of which 9 were decidedly railway companies.

11 years later, in 1895, another index was introduced. The index was the Dow Jones Industrial Average. It still exists to this day and is often referred to simply as “the Dow”. It is probably the most well-known index, although it has lost importance over the years, as tech has increasingly taken over market shares in the industry.

- A market-weighted index specifically consists of some given underlying shares in proportion to the market values they have in relation to each other.

If we get into the helicopter and fly high enough, we can look at the whole world through stock glasses, by looking at the index called MSCI ACWI, better known as the world index.

MSCI stands for Morgan Stanley Capital International and is the abbreviation for those who designed the index. - ACWI is an abbreviation for “All Country World Index”.

Here we are dealing with an index that contains stocks from North America over South America, a slip past Africa, Europe and large parts of Asia. In short, it stocks from all over the world.

WHAT CAN AN STOCK INDEX BE USED FOR?

If we think of a fictitious market-based index consisting of two shares, A and B, where A is worth USD 25 and B is worth USD 75, then A will fill 25% in the index and B 75%.

In any case, this is how the index will most often be constructed. Sometimes individual companies fill so much space that a CAP-weighted index is created, which means that a bar is set for how much individual companies may fill in the index. It is used in certain indices, as e.g., Amazon could fill too much in these indices, due to the company’s enormous market value (compared to other listed companies).

An index can be constructed very differently. First, they open up to be able to invest in different sectors.

How is the pharmaceutical industry doing in relation to the retail trade, for example.

- Even more important, however, is that an index creates an average return.

Based on the leading Danish OMX-C25 index, which consists of the 25 largest Danish listed companies, we can, on the basis of the index, say what the average return is. In other words, we can say something about how the larger Danish companies are doing overall.

We can therefore also begin to compare nations against each other, regions against each other and sectors in relation to each other. It offers almost endless possibilities for analysis.

In addition, the breeding ground for two fundamentally recognized investment strategies is being created.

Passive and active investment strategies, respectively.

WHAT IS PASSIVE AND ACTIVE INVESTMENT STRATEGIES?

When it comes to investing in stocks, there are two overall strategies. Passive and active investment strategies, respectively.

Because shares are divided into indices and an index is created with an average, it is, therefore, possible to be an average investor. To put together a portfolio of stocks that reflects the index 1: 1.

If company “X” fills 5% in the index, then company “X” must also fill 5% in the portfolio. It is a passive investment strategy.

The active investor, on the other hand, aims to beat the average return (by cost) in a given index. Here, the shares that the investor believes will perform better than the average are selected to create a return that is just higher than the average.

However, the active investor may risk underperforming and performing worse than the average return. Naturally, there will be a lot of people who do this, because the sum must be the average. Not everyone can do better than average, although most people think they belong to the part that can.

The costs are generally significantly lower with the passive than the active investment strategies. It is expensive to try to beat the market.

It also means that once costs are deducted, then passive investment strategies will often beat the active investment strategies.

- Everything else will be a mathematical impossibility.

However, a few active investors manage to beat the passive ones, but the vast majority will perform worse than average once the costs have been deducted.

Is there an easy way for passive investors to put together a portfolio of different indices?

BUY ONE FUND AND BECOME A CO-OWNER IN THOUSANDS OF STOCKS

It can seem quite confusing to buy all the shares individually in a given index. Which stocks give the highest return and how can one know for sure?

The probability that you will put together a portfolio that can handle the competition with the most talented in the world is very small.

So what can you do?

Funds exist in many different forms and under slightly different names. Basically, a fund is a very simple construction. A number of investors come together to invest their money and this is then done through the fund. Those who manage the fund make sure that the money is invested in a number of different companies.

It’s kind of as simple as it sounds. As an investor, you are helping to pay the costs of running the fund.

On the other hand, you do not have to select the shares to invest in and your time consumption is therefore minimal.

Depending on the size of the fund, you can become a co-owner of hundreds, even thousands, of different companies by simply buying units in the fund.

- Buy multiple stocks at once with ETFs

Funds are therefore a very easy and cheap way to spread your risk over many different stocks and thus avoid that your entire wealth and future rests in the hands of, for example, the next East India Company.

WHAT IS ACTIVE AND PASSIVE FUNDS?

Basically about actively and passively managed funds:

- An actively managed fund tries to beat the market (the fund’s benchmark).

- A passively managed fund tries to reflect the market (the fund’s benchmark).

The actively managed fund is often expensive to operate and the vast majority of actively managed funds will underperform on returns in relation to their benchmark.

The passive fund is often much cheaper to operate and will always seek to be as average as possible – that is, as cheap as possible.

Many funds today can be traded on the stock exchange on an equal footing with other securities such as individual stocks. So there is no difference whether you want to buy a stock or a fund when you sit in the armchair with your smartphone in hand.

So why not buy foreign low-cost funds “ETFs” and become co-owners of many companies at once?

You can simply buy many of the world’s listed companies by simply buying one global fund or by buying a combination of several different funds.

PASSIVE INVESTMENT IN SHARES WITH ETORO

At E-Toro, they have made it easy and convenient for you to share in the future value development of the world’s listed companies.

With an investment via e.g. The ETF VTI becomes a co-owner of thousands of different companies around the world.

Of course, this is a passive investment strategy through Vanguard, because as you now know, passive investment strategies are often far superior to active investment strategies.

E-Toro has even made it incredibly easy to get started:

- First, create a free investment account

- Then you transfer money to your depot and

- Search the ETF VTI and press BUY

- Shortly after, you can follow your investments via the E-Toro app and the website.

It’s not harder.

Pingback: is it worth investing 100 a month? - FIREJOURNEY