is it worth investing 100 a month?

Yes, Investing 100 a month for long period of time will compound to an incredible saving over time. Read on to see how much 100 a month become over a period of 10, 20, 30 and 60 years. Many people who are new to investing often have the question of whether they have enough money to start investing. “Is it really enough that I” only “have 500, or maybe only 100?”.

My answer is a resounding YES. Remember that every penny count, and you are incredible that you have made the choice to get started! Small steps are also steps, and you as an investor will grow at exactly the pace that feels best for you, and the same will your portfolio. That you have started is FANTASTIC!

How do I start investing with little money?

You have to deposit the money into a brokerage account such as eToro, or other brokerage. Afterwards you select a stock or ETF you want to invest the money into. Broad market index funds or ETF such as VTI, SCHD, DGRO or VOO is simple, very low risk, but yet very rewarding with a historic compound of 7-10% yearly returns.

You can buy one or more shares, or fund units, for e.g. 100 (if you want to read more about funds then I have an article about these HERE). What many people complain about is how much brokerage fee (the fee the bank takes when buying and selling) they must pay. The usual thinking is that it is not worth it, to get started if you have to pay a high fee, when buying stocks.

The reason I recommend E.g., eToro is because they have fractional shares, meaning you can buy a part of a stock and not forced to buy a whole unit of a stock. This becomes important with the smaller amount you have for investing. The other point is the lack of minimum brokerage fee e.g. 3 USD per purchase like Saxo Bank. eToro is completely free of fees and therefore a small investing amount get more or less all invested. eToro does have a minimum investing amount on 50 USD, but no fees.

By minimum brokerage fee, I mean that you pay e.g. 3 USD regardless of whether you shop for 1 USD or 300 USD – in addition to this, if you come up with higher sums, they might charge a percentage.

I want to mention you can have more brokerages/banks if you want, you can find my article on how to choose your investment platform HERE. I invest myself via eToro because I think they have an easy user interface and free stock trading. However, I do not think that the brokerage is worth much to talk about in the beginning. I’d rather you see it as a lesson, and rather focus on actually getting started. That’s the important thing in the beginning.

Get started with investing, by investing monthly

I suggest making it a habit to invest monthly in your investment account. This is an easy, quick and cheap way, to get started investing. It does not take that long to get set up and when you are done it all runs automatically. I.e., you do not have to spend time tracking your investments or trade on a daily basis.

What is also very positive about a monthly investment habit is that you do not get carried away when the market goes down. In the very beginning you will follow your money close (I could check like multiple times a day or even check it out for hours when I first started). I can tell you now that they will dip after a few days and that is terrifying. But if you can take your emotions out and hold off on the sell button you will be rewarded for your patience. You can read my article about Dollar Cost Average and read what is the benefits of just investing monthly.

Therefore, if you can save up to 500 a month (or whatever amount), simply deposit them on the same day each month into your investment account and invest them in the funds I mentioned earlier. You will be amazed about the amount you will have saved up after a few years doing this. Continue reading this article about compound interest.

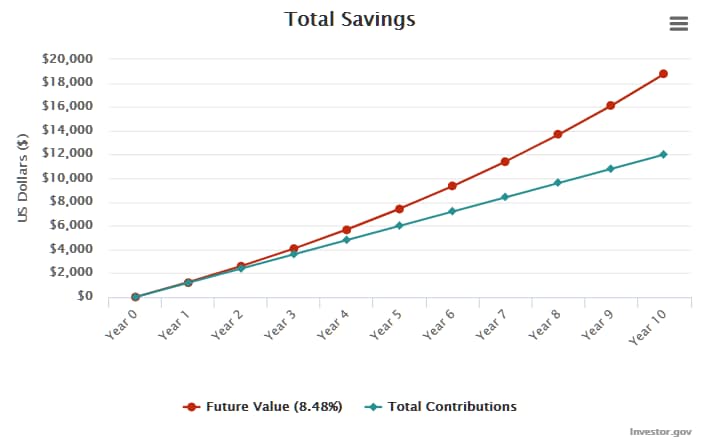

How much will 100 a month grow over 10 years period?

Using a compound interest calculator found here, we can easily calculate the growth of our 100 invested each month. Before we start we have to provide some additional numbers for the calculation. I will put the assumption we have 0 in initial investments, we are investing everything into a broad stock market index funds like VTI (Vanguard Total Stock Market Index Fund), this particular fund have an annual return of 8.48% since inception (It does have a 13.79% return over the last 10 years). For this example let’s use 8.48%. Our period is going to be 10 years as mentioned in the title and we will invest 100 each month or 1200 each year.

You will have contributed 12000 over a period of 10 years, however, your portfolio would be worth 18,792.72. This is truly amazing already! You used 12000 of your hard earned money and got 6.792 in return for no work! passively!

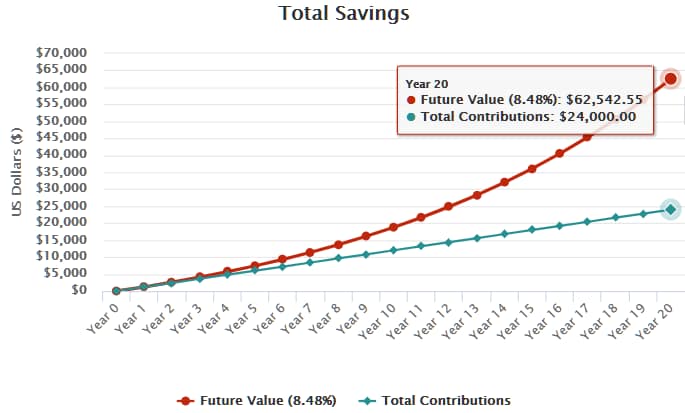

How much will 100 a month grow over 20 years period?

Again using the compound interest calculator, we can easily calculate the growth of our 100 invested each month for 20 years! Before we start we have to provide some additional numbers for the calculation. I will put the assumption we have 0 in initial investments, we are investing everything into a broad stock market index funds like VTI (Vanguard Total Stock Market Index Fund), this particular fund have an annual return of 8.48% since inception (It does have a 13.79% return over the last 10 years). For this example let’s use 8.48%. Our period is going to be 20 years as mentioned in the title and we will invest 100 each month or 1200 each year.

You will have contributed 24000 over a period of 20 years, however, your portfolio is worth 62542,55!. How crazy is that? We only waited 10 more years than previously and got a return of 38.542! Remember we did not work!

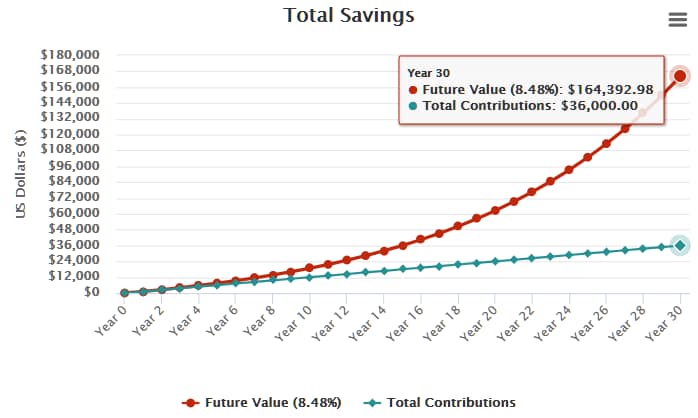

How much will 100 a month grow over 30 years period?

Again using the compound interest calculator, we can easily calculate the growth of our 100 invested each month for 30 years! Before we start we have to provide some additional numbers for the calculation. I will put the assumption we have 0 in initial investments, we are investing everything into a broad stock market index funds like VTI (Vanguard Total Stock Market Index Fund), this particular fund have an annual return of 8.48% since inception (It does have a 13.79% return over the last 10 years). For this example let’s use 8.48%. Our period is going to be 30 years as mentioned in the title and we will invest 100 each month or 1200 each year.

You will have contributed 36000 over a period of 30 years, however, your portfolio is worth a whopping 164.392,98!!. This is truly incredible! You used 36000 of your hard earned money and got 132392 in return for no work! Totally passively!

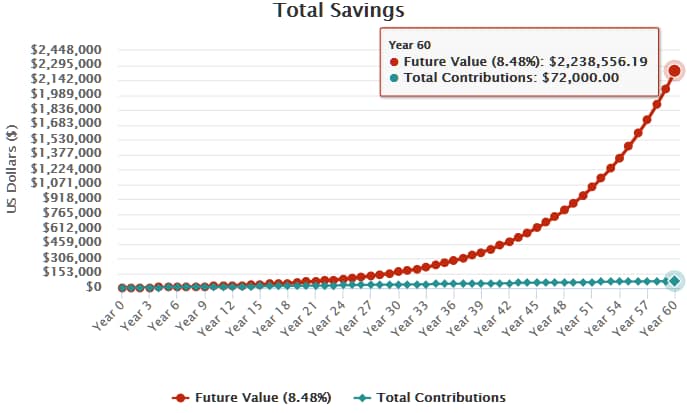

How much will 100 a month grow over 60 years period?

The last scenario using the compound interest calculator. This time we wait 60 years before we look at our portfolio we consistently have deposited 100 into each month! Before we start, here is our assumptions, we have 0 in initial investments, we are investing everything into a broad stock market index funds like VTI (Vanguard Total Stock Market Index Fund), this particular fund have an annual return of 8.48% since inception (It does have a 13.79% return over the last 10 years). For this example let’s use 8.48%. Our period is going to be 60 years! and we still invest 100 each month or 1200 each year.

Look at that graph! What an explosion of compounding! After 60 years you will have contributed 72.000. BUT, your portfolio is worth a choking 2.238.556,19!!. THIS IS OVER 2 MILLION! You only used 72000! but got 2.166.556 in return for no work! Totally passively! CONGRATULATIONS YOU TURNED 100 into 2 million. FYI after 51 Years of investing 100 each month you would cross the 1 million mark! only 8 more years to cross the 2 million.

I hope you found this article useful, and do try to play around with the calculator. I started with a limited amount, but now I aim to invest at least 2000 each month! When you see the growth potential, you tend to get excited!

Pingback: cialis