Shares for minors are not that widespread yet. However, there are good conditions in the stock market starting early.

With the technological development, it has become even easier to invest as a young person, even if you are under 18 years old. Shares for minors have thus become more popular, and it is also advantageous to start early.

How do you invest when you are under 18?

When you are under 18, the process of getting started is a little longer than when you are over 18. You can most likely set up a depository through your own bank, but the optimal solution for people under 18 is a no commision brokerage.

To create an account for minors on you must sign some different papers, after which the account will be approved. Personally, I have experienced that it can take anywhere from 1 week to 2 months to be approved as a minor.

When you have a minor account on your brokerage, you do not have the power of attorney over the account; it must be one of your parents or guardian. In practice, this means that the person with the power of attorney makes the trades. When you turn 18, the power of attorney will be yours and you can act independently.

Several brokerages has recently experienced increasing interest in an account for minors, which we see as a positive sign. Customers who are minors are both attractive to brokerage, while investing as a young person offers great benefits. So a win-win situation arises between the brokerage and you when you get started.

Why invest as a young person?

There are many different views on whether one should invest as a young person. Personally, I heard persons as young as 12-year-old, and many wonder, and think they should have spent money on having fun, going to town, shopping, etc .. The thing is, they just have fun investing, and therefore, it is of course very individual whether one should invest as a young person.

However, I will still focus on the benefits of starting early, as it can be educational, fun and lucrative in the long run.

The young investors’ best friend

Young investors have some advantages that no old and experienced stock-savvy people have.

One advantage in particular stands out, namely our long-term time horizon, which can be used to make a lot of money. When one’s equity strategy is long-term, there are even more years to get a return, and thus also get a return on one’s return. This is also called the compound interest rate effect.

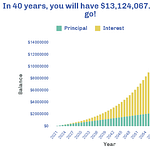

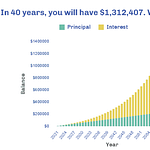

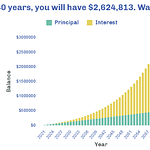

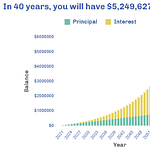

In the tabs below, you can see some examples of how the interest rate effect works in practice.

Investment of 500 per month will, with an average market return of 7%, develop as follows over the next 40 years:

Investment of 1000 per month will, with an average market return of 7%, develop as follows over the next 40 years:

Investment of 2000 per month will, with an average market return of 7%, develop as follows over the next 40 years:

Investment of 5000 per month will, with an average market return of 7%, develop as follows over the next 40 years: