We’re going to talk about some of the pros and cons of investing in individual dividend stocks versus dividend ETFs and this really from a perspective of a do-it-yourself investor.

What i’ve noticed if you do a google search or look at different articles on the pros of etfs and the pros of individual stocks doesn’t really help you as a dividend investor. At least that’s been my experience. When I’ve been researching and watching different videos reading different articles and blog posts on this topic.

I have noticed that it’s been a little bit generic, and i want to go into depth about why I invest in one, the other, or both.

This article is not going to be generic it’s not going to be just very high level. I’m going to go into detail and share with new investors or beginner investors what they are asking themselves this question.

Maybe you’re setting up your portfolio for the first time or you’re re-evaluating your portfolio to make sure that you’re on the right track then the information that i’m going to provide here are all things that I have had on my mind for years, and I’m going to share with all of you how I as a do-it-yourself investor what are the things that I review and consider when investing in one or the other or both.

The benefits of investing in individuals companies

Let’s take a look at some of the the pros of investing in the individual stocks we’ll start there so one of the the first pros that come to mind when investing in individual stocks when you’re building out your portfolio, whether you’re using m1 finance, vanguard, eToro or whatever brokerage whether you’re here in the united states or international the number one thing that comes to mind or the first thing is control.

You have more control

You have control over which investments are in your portfolio. If you’re investing in an etf this is not necessarily the case because you’re buying the Index. You can specify, I want consumer goods, and you’re just going to buy that particular Index, but you don’t have full control over the allocation that the individual company or the company in that Index where you do if you have individual shares of the company in your portfolio

That’s the very first thing and so with different brokerages, you can set up your portfolio that way with m1 finance what I like about m1 finance is you can set up your allocation very seamlessly, say for example, if we were to go into an industrial slice. I can set up how much exposure I want to have to 3M(MMM) versus Waste Management(WM) versus UPS versus Honeywell, and etc.

I have control over what percentage these individual companies have in my portfolio. Therefore, as a do-it-yourself investor having that control can be very valuable.

You have potentially higher returns

Another pro to investing in individual stocks is your return potential. If you were to invest in the Kimberley Clark back in 2010, reinvested the dividends and invested ten thousand dollars, you would have an annual return of almost 13%.

If you were to invest in an ETF that follows the consumer staples index like the Vanguard VDC (VDC) you would have a lower return. But, tho it’s still a great return, you have more potential with individual stocks to have higher returns.

The potential return is not a guarantee like an emphasis should be on the potential

You can select companies based on your belief in responsible investing

Another pro to investing in individual stocks is the emotional aspect of investing in supporting a business you want to support. A business that is socially or environmentally responsible financially.

For example, you could invest in certain utility companies that are more skewed towards renewable energy. On the other hand, you could take an approach to focus on more socially or environmentally responsible companies, and if that’s important to you, you could do that with individual stocks.

You get the total flexibility of the dividend payout schedule

Another benefit of individual stocks is the dividend payout schedule. I don’t recommend investing in individual companies just because of their payout schedule, but this is an advantage that individual stocks have over ETFs is your flexibility with the payout schedule. For example, the majority of ETFs are on the schedule: March, June, September and December payout. But for example, if you want to invest in companies that were on a July or an august schedule, you could invest directly into these businesses and get paid at specific times that meet your goals and your priorities

The disadvantage of individual stock investing

Let’s talk about some of the disadvantages of investing in individual companies

Concentrated Risk

One that comes to mind is concentrated risk. Not in all cases this is the case (I mean, some really good companies like Johnson and Johnson(JNJ) McDonald’s are very well diversified), but in most cases or in many cases, there is a concentrated risk when you’re investing in an individual company. That can be a company focused on one product, one service, or one location – A company with more negligible diversification.

The risk of companies going through bankruptcy

The second con that comes to mind is the worst-case scenario when you invest in an individual company, and afterwards, they go bankrupt like their stock goes to zero, and you lose everything.

There are a few examples when we look back at companies that went bankrupt recently if you were a jcpenney shareholder, or a kodak shareholder.

If you invested in other retailers as of late, this has been an area where this concentrated risk has not paid out for the long-term investor, and that is an absolute risk or a con that comes with investing in individual stocks.

When we talk about diversification, there is, in most cases, more negligible diversification when investing in individual stocks. However, you can counter this by holding multiple companies in your portfolio. For example, If I wanted to invest in healthcare and I just invested in Johnson and Johnson. I would be very concentrated and I would have less diversification than I personally would feel comfortable with. One could argue Johnson & Johnson is a very well-diversified company having multiple business units, and they have B2B and B2C business lines hence, a lot of diversification with this investment, but if you invested in for example a pharmaceutical company you had all of your exposure to health care in for example pfizer, and abbvie you’d be very limited with your diversification for that sector

but by having multiple companies in your portfolio, you’re able to counter that con with investing in the individual stocks

The emotional rollercoaster

Another con with investing in individual companies is the emotional rollercoaster that comes with it one day your stock is up the next your stock is down.

Always seeing that fluctuation going up and down can be very emotional, and it can have a toll on new investors, and I think that it is something that gets understated in the finance community is really the impact that emotions play in investing into whether individual stocks or etfs so really not underplaying the the impact of the emotional distress that that comes with investing into individual companies

The false sense of control

another con that comes with investing into individual stocks is that false sense of control that being you know you’re doing your fundamental and your technical analysis before you invest into a company and you know looking at general electric for example up until the financial crisis of 2008-2009 general electric was always up and to the right they were rate they were beating and raising every single year business was great but with with a financial crisis of 2008-2009 general electric just fell off a cliff is what it looked like and so having that false sense of control when you’re looking at the fundamentals everything looks great in 2007 2006 and then all of a sudden the financial crisis hits then you’re you’re taken through this this roller coaster and i think that is a big risk that comes with investing in individual companies is relying on the fundamentals and thinking that you know better and having that false sense of control whereas in reality we we maybe necessarily can’t control the the outcome of a bad management at an organization.

Not every organization is run properly for management there’s different priorities you know you look at the example of what’s been going on with wells fargo with the the scandal that they they’ve had i mean it’s just uh you know it’s been kind of a roller coaster if you’re you’ve been a a shareholder of wells fargo i’m not hating on on wells fargo or shareholders that hold wells fargo i’m just merely saying that you know this is an example of you know that that maybe that false sense of of control that comes with investing into individual stocks

It takes more time to keep updated

another con that comes with investing in individual companies is the time that it takes to follow up on investments now if you really want to make sure that you’re making the right decision you’re following up on these companies you’re following up on their balance sheet you’re reviewing them you’re staying up to date this becomes a little bit more active and less passive and therefore it is a con in my perspective of investing in individual companies because it does require you if you want to do it right to follow up on these businesses

The benefits of investing in dividend ETFs

let’s take a look at some of the pros of investing into dividend etfs

Diversification

The first thing that comes to mind i think this is what everyone can wrap their head around is diversification you’re getting a basket of companies with this single investment and you’re spreading out your risk and you’re increasing your exposure to multiple industries multiple product lines multiple services multiple locations etc.

You’re spreading that diversification out and you’re protecting yourself against over concentration for me that is an absolute benefit to investing into dividend etfs.

No need to be financial guru or expert to get great returns!

The second thing is you don’t have to be a financial guru or an expert to get great returns. If you invest into an index or a you know just the s p 500 you don’t have to be an expert.

You can invest with confidence and you don’t have to feel like you have to know everything to get great returns.

It the only true passive approach to passive income

another pro to investing into dividend etfs is in my opinion this is the most true passive approach to cash flow to passive income dividend etfs are the most purest form of dividend cash flow and passive income that’s my opinion i i believe that this is really a way for new investors to get exposure to the stock market start generating passive income through dividends from dividend growth etfs

You can sleep well at night

another pro to dividend etfs is that sleep well at night factor this really cannot be underestimated for all of you that were in the stock market back in march and april you might have seen this roller coaster you might have felt a little bit overwhelmed you know if you’re a brand new investor you might have been you know losing some sleep at night thinking you’re going to lose everything with etfs you really can feel comfortable and sleep well at night that when you see the portfolio go down you can really average in you can dollar cost average and average in with confidence into etfs and this has been my personal experience. I’ve invested into companies in the past when i first started investing that went bankrupt and so investing in the etfs i feel very comfortable averaging down and doubling down knowing that my investments are in almost every case not going to go to zero.That is a big advantage of investing into dividend etfs that is not really talked a lot about.

Self Cleansing

Another pro to dividend etfs and probably my favorite is that indexes etfs are self-cleansing and so what does that mean self-cleansing it means a lot of these etfs they’re following an index or they have a set benchmark of how they manage these index indexes and if a company no longer meets a criteria the criteria of the Index or of the etf then it is taken out of the etf and a new company is put in it is capitalism at its finest. So for example all the companies in SCHD in order to be included into this etf the company has to have paid a dividend for at least 10 years if the company were to stop paying a dividend this company would be taken out of SCHD and would no longer be included into this etf that is what i mean by self-cleansing and so that’s what i mean by it being passive you as the investor you don’t have to follow up on the companies. You don’t have to do the research and so it is incredibly passive all right.

The disadvantage of investing into Dividend ETFs

let’s take a look at some of the disadvantages of investing into dividend etfs right.

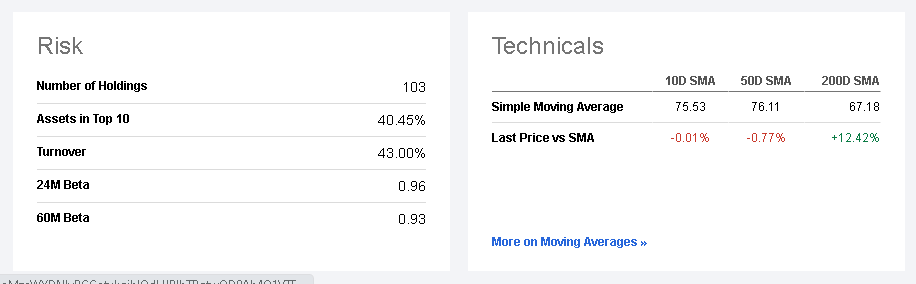

SCHD the high dividend etf from Schwab. Over at seeking alpha something that i want to talk about if you scroll all the way down to the bottom here you can see the risk tab so you can see the number of holdings the assets in the top 10 right that’s the percentage of the top 10 holdings that make up the overall etf and the turnover.

Turnover

I want to talk about the turnover one of the cons of investing into dividend etfs is you have less control over the holdings and the turnover. We talked a little bit earlier about you know the criteria for a company to be in an etf and to be in the Index. In some cases the etfs will have higher turnover that means the companies that are in the etf that they’re shuffling more coming in and more falling out so the higher percentage of the turnover that means that this etf is burning and churning they’re bringing in and they’re taking out they’re bringing in and taking out individual companies at a higher rate so the higher the turnover rate that means the more fluctuation of the holdings in the etf

It cost money to invest in ETFs

Another disadvantage of investing into dividend etfs is it costs money to own them in in this case for example the expense ratio is what you as the investor pay to hold to own this etf this money is going to the fund manager to the fund itself to manage these etfs now this is you know the examples that i use on my channel are index funds they’re not mutual funds and the big difference is is the difference between actively and passively managed and all of the the etfs in my you know the index funds in my account that i own are all index funds so they’re passively owned so the expense ratio is lower but that is a con of etfs is it cost more money to own them versus just owning the individual company outright

Be aware of tax surprises

another con of owning dividend etfs are in the form of tax surprises so let’s say for example you you purchase an etf and you expect to pay lower taxes at the capital gains rate but in reality you’re actually taxed at a different rate because in that etf there are real estate investment trusts in the etf and therefore they’re taxed differently so there are there can be some tax surprises if you don’t know what you’re doing for example the etf that i’m showing here the schwab schd has zero exposure to real estate there are no reits in here so this etf is taxed much more favorably than for example a an etf that is concentrated on real estate investment trusts

so something to be very very aware of

The performance of the ETF is tied to the Index

another con of dividend etfs is that the performance of the etf if it follows an index for example a consumer staple or a real estate or a community communication services index the performance of the etf is tied to the Index so if the Index is down the etf the performance of the etf will be down

Less predictable dividend payout

another con of investing in the dividend etfs is really forecasting and predicting future dividend payouts the dividend payout is a little bit less predictable than if you were to invest into a a company like coca-cola or pepsi where it’s been more consistent and you can really forecast the dividend amounts that you’re going to be getting as a dividend investor compared to to an etf

Why I invest in Individual companies and in dividend ETFs

I want to share with all of you a couple of reasons of why i invest into individual companies and why i invest into dividend etfs.

Dividend ETFs: I’m bad with emotions

The first reason why i invest into dividend etfs i’ve learned from myself i suck with my emotions i am so bad with my emotions and investing in the etfs it helps me to control my emotions better and especially when it comes to my finances and when it comes to my future when i’m planning or when my wife and I when we’re planning for our financial independence journey emotions can be very tense and high and so this is a way for me to lower my emotions and to focus really on what matters.

Dividend ETF helps me sleep at night

The second reason is it helps me sleep at night. I didn’t lose a night of sleep in march and april when the market was crashing in some cases 30 40 and 50 percent. I didn’t lose a second of sleep over over my portfolio in fact i actually was averaging down and investing more when the market was going down.

I like having more control

Why i like investing in individual companies is i like having a little bit more control i am a dividend nerd i do love following up on on some of the companies that i have in my portfolio it is a hobby of mine i love the fact that i have more control i can invest in wonderful businesses that pay their dividend. It is not just on the traditional pay schedule in march june september and december i can spread out my dividend payments a little bit more without sacrificing quality in my investments.

I hope this article was helpful what i’ve learned at the end of the day when it comes to deciding whether or not you want to invest in individual dividend stocks or dividend etfs you have to understand what are the pros and cons and what’s most important to you. Especifically if you ask other people their opinion of should you do this or should you do that. You’re going to get mixed signals, different advice, and different opinions what i’ve learned is you have to do what’s right for you and understanding both sides and choosing what works for you.