WHY INVEST WHEN THE MARKET IS AT ITS HIGHEST?

KEY TAKE-AWAYS:

- People have a record amount of money in deposit accounts with the bank – many of these even have accounts with negative interest rates. It can make a lot of sense for many to invest their money.

- Although the stock market is “all-time high”, there are many good arguments for investing your money in the market anyway.

DID YOU KNOW DANISH PEOPLE’S DEPOSITS IN THE BANK ARE OVER 1,000 BILLION DKK.

At the end of 2020, Danes’ total deposits in Danish banks amounted to more than DKK 1,000 billion, according to figures from Danmarks Nationalbank.

Many Danes have a lot of money in their deposit account at the bank. It is no secret that many people pay negative interest rates on their deposits in the bank – the vast majority of the country’s banks have introduced negative interest rates on their deposit accounts in recent years.

However, the money can generate a far better long-term return by being invested than just standing in a bank deposit account.

The negative interest rates and inflation eat away at your savings – so it is immediately a really bad solution for your savings to have it in the bank.

WHEN DOES IT MEAN TO HAVE CASH STANDING IN THE BANK?

Even if the negative interest rates and inflation eat away at your savings, it is not always irrational to have cash in the bank.

There are at least 2 good arguments for having a certain amount of money standing in the bank.

- As a private investor, for example. a short time horizon of less than 3 years, then as a general rule it does not make sense to invest the money.

There are costs associated with trading and there are greater risks of being left with a total loss when one has a short time horizon. - As a general rule, you should always have enough money left in the bank to pay for unforeseen expenses. You can save a lot of money on this, so you do not have to go out and take out expensive short-term debt unnecessarily. Read more about building an Emergency Fund here

On the other hand, it is not a good argument to have cash standing in the bank “just” because you think that the stock market is high / expensive / overheated or whatever you call it.

THE DECISION IS NOT WHETHER THE MARKET IS “ALL-TIME HIGH”

Your friends may often talk about how expensive the stock market is – the media likes to write about the same thing. It may make you doubt whether it might be stupid to invest now? Maybe you should wait?

No, you should not wait. There are several good arguments for this.

- Historically, the global stock market has yielded positive returns of approx. 4 out of 5 years (ie 80% of all years). It is therefore difficult on average to time the one year in which the market returns negatively.

- If you are out of the market just a few trading days a year, you may risk losing large parts of your long-term return on investment. You must therefore always be invested in the stock market.

- It is impossible both to time the market and to select winning stocks – even the experts fail. So it is quite impossible to buy shares “cheaply” and then sell them “expensive” successfully.

- Although there have been several major stock crises in recent centuries, stocks have typically always regained what they lost in just a few years.As an example, the global stock market fell approx. 30% below the corona’s intake in early 2020, but it regained what it lost in less than 1 year.

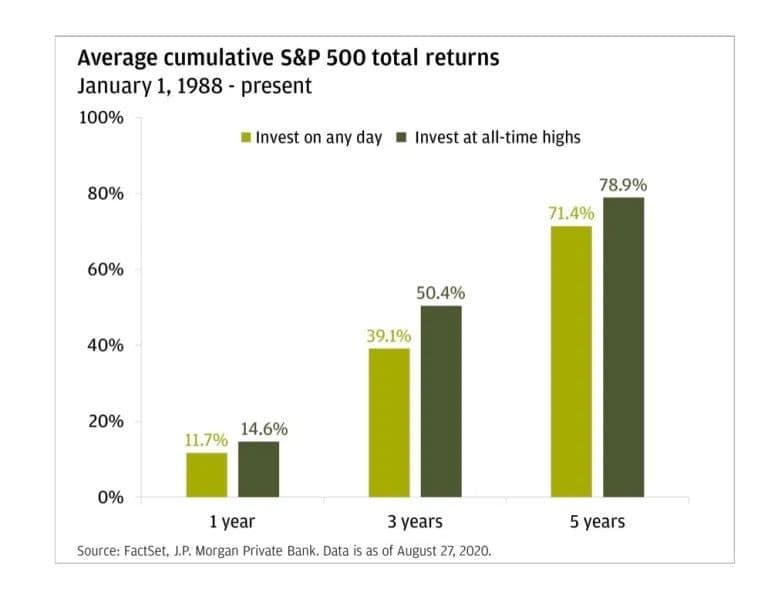

- Stock markets will often be at their highest levels before, of course, they can reach new heights. Statistics from the US S & P-500 index (from J.P. Morgan) actually show that as an investor you have been better served by investing on the days when the index has been at its highest than on randomly given days. It provides food for thought.

See a graph from J.P. Morgan below:

So there are many good arguments for getting started investing regardless of the current market rates.

So how do you invest in the smartest way?

INVEST LONG TERM AFTER A PASSIVE INVESTMENT STRATEGY – THE PATIENT INVESTOR WINS

The stock markets are from time to time characterized by negative sentiments, but over the longer term, the markets have historically always overcome even the worst corrections and crises. Thus, the patient investor is always the winner in the long run. The rationale is to follow a passive investment strategy and be satisfied with the long-term return on equity that the markets have provided.

INVEST WITH REGULAR PAYMENTS

By regularly paying in for investment, you buy both when the market is cheap and expensive. The smart investor also invests on an ongoing basis. This can be done by setting up an automatic transfer every month.

The smart investor knows that it is neither smart to try market timing nor stock selection. He is fully satisfied with the market return. So if you are worried about whether now is the right time to enter the stock market or not, then ongoing payments can ensure that you spread your risk over time. Read more about Dollar Cost Average in this post